does colorado have an estate or inheritance tax

Most people dont have to worry about the federal estate tax which excludesup to 1158 million for individuals and 2316 million for married couples in the 2020 tax year. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

Colorado Estate Tax Do I Need To Worry Brestel Bucar

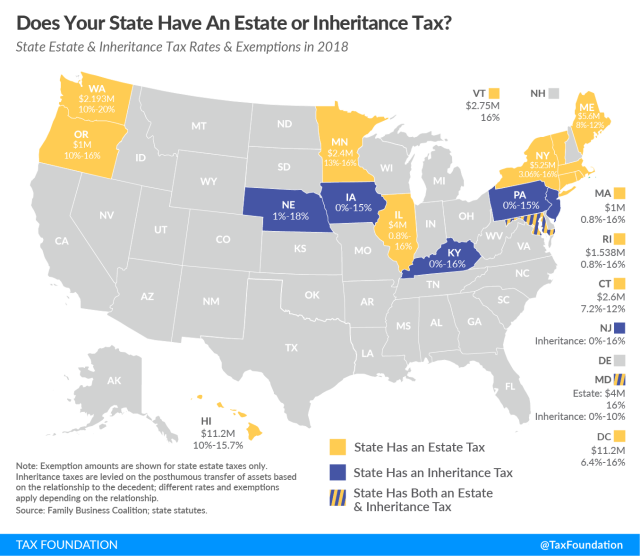

Twelve states and Washington DC.

. The exemption for that tax is 1170 million for deaths in. Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicated. Typically when someone refers to a death tax they are likely referring to an estate or Colorado inheritance tax as defined above.

The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to the modified federal taxable income. Currently fifteen states and the District of Columbia have an estate tax and six states have an inheritance tax. But that there are still complicated tax matters you must handle once an individual passes away.

Estate tax can be applied at both the federal and state level. Informal process generally allowed when there is a. After you die someone will become responsible for taking over your estate and determining whether it owes any estate taxes.

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. Although both taxes are often lumped together as death taxes Twelve states and the District of Columbia have estate taxes as of 2022 but only six states have an inheritance tax Maryland has both taxes. Maryland is the only state to impose both.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. The inheritance tax is not based on the overall value of the estate. As a matter of fact.

Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas and Wyoming. For 2021 this amount is 117 million or 234 million for married couples. States that currently impose an inheritance tax include.

Devisees or heirs may collect assets by using an affidavit and do not have to open a probate action through the court. Colorado has a flat income tax rate of 455. However not many states have an estate tax.

Thats an estate tax. When it comes to federal tax law unless an estate is worth more than 5450000 no estate tax is collected. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. The state with the highest maximum estate tax rate is Washington 20 percent followed by eleven states which have a maximum rate of 16 percent. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax.

Federal legislative changes reduced the state death. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

In fact only six states have state-level inheritance tax. Maryland and New Jersey have both. There is no inheritance tax or estate tax in Colorado.

The good news is that Colorado does not have an inheritance tax. But that there are still complicated tax matters you must handle once an individual. Up to 25 cash back Who Pays State Inheritance Tax.

There is no estate or inheritance tax collected by the state. There are 33 states that have neither estate taxes nor inheritance taxes. The states with this powerful tax combination of no state estate tax and no income tax are.

Estate tax is based on your legal state of residence not where you die. Inheritance taxes are different. First estate taxes are only paid by the estate.

Colorado does not have an inheritance tax or estate tax. Impose estate taxes and six impose inheritance taxes. There is no federal inheritance tax but there is a federal estate tax.

Small estates under 50000 and no real property. The state of Colorado for example does not levy its own estate tax. Hawaii and Delaware have the highest exemption.

Does Colorado Have an Inheritance Tax or Estate Tax. Some states might charge an inheritance tax if the decedent dies in the state even if the heir lives elsewhere. 117 million increasing to 1206 million for deaths that occur in 2022.

Types of Estate Administration. Inheritance tax is a tax paid by a beneficiary after receiving inheritance. No estate tax or inheritance tax Connecticut.

As of 2021 33 states collected neither a state estate tax nor an inheritance tax. However Colorado residents still need to understand federal estate tax laws. Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment.

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Even though there is no estate tax in Colorado you may still owe the federal estate tax. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year.

Note however that the estate tax is only applied when assets exceed a given threshold. For deaths in 2021-2024 some inheritors will still have to pay a reduced inheritance tax Kentucky. A state inheritance tax was enacted in Colorado in 1927.

Washington doesnt have an inheritance tax or state income tax but it does have an estate tax. 4 The federal government does not impose an inheritance tax. In some states a person who receives an inheritance might.

The good news for retirees focused on estate planning. A federal estate tax is in effect as of 2021 but the exemption is significant. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit.

States Without Death Taxes. This is per IRSs basic exemption of 5 million indexed for inflation in 2017. Does Colorado Have an Inheritance Tax or Estate Tax.

If it does its up to that person to pay those taxes not the inheritors. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax.

There is no inheritance tax in Colorado. Colorado Inheritance Tax and Gift Tax. Iowa but Iowa is in the process of phasing out its inheritance tax which was repealed in 2021.

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

A New Tax Study Should Freak Out Billionaires

Free Vector Estate Tax Composition Real Estate Book Estate Tax Vector Free

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Retiring In These States Will Cost You More Money Vision Retirement

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Recent Changes To Estate Tax Law What S New For 2019

How To Avoid Estate Taxes With A Trust

Recent Changes To Estate Tax Law What S New For 2019

How To Avoid Estate Taxes With A Trust

The Procrastinator S Guide To Wills And Estate Planning Estate Planning Estate Planning Checklist Funeral Planning Checklist

State Estate And Inheritance Taxes Itep

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit